Sunday, August 17, 2008

4 oil service stocks

4 oil service stocks

History Lesson about Value Investing from Ponzio

Value Investing vs. Value Pretending

For more than 50 years, great "value" investors — Warren Buffett, Benjamin Graham, Charlie Munger, Seth Klarman, to name a few — have been touting the benefits of investing when there is blood in the streets, buying businesses when they are on sale. At each turn, somebody would ask them: Aren't you concerned that, by constantly talking about how you became so successful, you'll create a following that will, in turn, increase competition and reduce your potential investment returns?

It is said that value investing is more popular today than ever before. I tend to disagree.

Investing ... 50 Years Ago

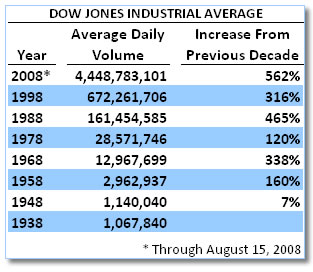

I am going to journey back to a time before I was born: 1958. The Dow Jones Industrial Average [DJIA] averaged about 10% a year from 1948 through 1957 (when looking at the average closing prices during that time). Stock prices were quoted in eighths and quarters, but most regular people only saw those quotes once a day — in the morning paper.

This was a time when you had to call a broker for a stock quote, who would in turn call a floor broker, who would then get the quote and update your broker. Assuming you didn't wait on the phone, your broker would call you back with a quote — sometimes several minutes later. Real time quotes and information? Not even a pipe dream yet.

It is said that Buffett never even had a tickertape machine in his office. And even if he did, how quickly could he really get price quotes? I mean — look at these things (right).

What chance did you have as a trader? Were you hand-plotting charts as they came across the tape? Then what? John Bollinger wouldn't be around to draw Bollinger Bands for another twenty-some years, Gerald Appel's MACD was still ten years away, and by the time you figured out your moving averages...they moved.

For the most part, regular people had absolutely no chance at being successful traders, speculators, or "growth" investors. To invest in stocks, you had one choice — buy stock in businesses that you would be comfortable holding for (i) at least an entire day, and (ii) regardless of the short-term swings.

There was no access to quick information; so, regular people had to buy knowing, and comfortable with the fact, that the price might be a few eighths or a few quarters higher or lower the next day. And when it was, you couldn't get too excited or too panicky because it took time for your broker to get an updated price — a price that could change rapidly in the few minutes it took for your broker to get the price, phone you back, take your order, and place and fill the order.

Investing Versus Speculating ... 50 Years Ago

Unless you were down on the floor of the exchanges every day, you had one of two choices: Buy great businesses when they were on sale (or down) or Buy random stocks, close your eyes, and hope for the best. In my dealings with people who had been saving and investing in the 1950s, I have found that most people opted for the first strategy. Even the most unsophisticated of investors invested soundly — buy great businesses, particularly when their prices were falling, and stay away from everything else.

What differentiated Warren Buffett from Aunt Bea and Grandpa Earl? One simple, yet often overlooked, thing: the breadth and scope of their respective Spheres of Confidence and Competence. Buffett was comfortable investing in a Sanborn Map — buying the business for less than the value of its stock and bond portfolio. Aunt Bea and Grandpa Earl didn't look for Sanborn Map; and, had they seen it, they didn't have the business and financial sophistication to buy and profit from it. Sanborn Map was outside their Sphere.

You know what else Aunt Bea and Grandpa Earl didn't do? They didn't see Buffett buying Sanborn Map and think, "Hey, we can do that too. Let's break up some businesses." Instead, they plodded along, buying stock in AT&T (T), Texaco, and other companies that seemed to have a big, sustainable presence in their area.

To Aunt Bea and Grandpa Earl, Sanborn Map was pure speculation. You know what? They were right! If they invested in Sanborn Map — without having Buffett's eye or ability — they would have been speculating. To them, speculating was uncomfortable and was to be avoided at all costs. After all, their goal was to invest so that they could one day be comfortable, and being uncomfortable throughout the process didn't make a whole lot of sense.

Along Came Wall Street

The 1950s began the Golden Age for Wall Street. Prior to that, brokers traveled the country, knocking on doors and selling stock. They would get checks from customers, finish their sales route, and then place the orders together — sometimes weeks after the customer first wrote the check. Remember: This was long before ACH, cell phones, and laptops. For crying out loud, Elvis Presley was just getting into the Army and it would be another year before Alaska would even become a state.

Technology. Advertising. Profits. By 1958, 83% of US homes had televisions — up from less than 1% in 1948, half of which were in or around New York City. And with television came...Wall Street commercials. It didn't happen overnight; but, eventually, the stock market became an exciting place where fortunes could be made...quickly.

The Schism on the Street

Aunt Bea and Grandpa Earl were not profit centers for Wall Street. They were boring, buy-and-hold investors — the type of clients a broker could go broke with. So, Wall Street had to "educate" them — teach them the difference between growth and value investing.

Sure, value investing is safe...but it's slow. Who wants 10% or 12% a year? These other stocks are ready to explode. They're gonna grow. They're...they're...they're growth stocks. Investing in growth stocks can get you to your goals two, no three, no...ten times faster.

Perhaps Aunt Bea and Grandpa Earl don't buy it. But their kids do. Born in the 1950s and 1960s, they started working and thinking about saving in the late 1970s and 1980s. Throughout the 1980s, young investors were growing more confused than their parents had ever been. On the one hand, the stock market was soaring and hostile takeovers, leveraged buyouts, and mega-mergers spawned a new class of billionaires. On the other hand, inflation and interest rates were out of control, banks were failing left and right, and the stock market was growing ever more volatile.

Aunt Bea and Grandpa Earl knew virtually nothing about the activities on Wall Street. All they knew was that Coca-Cola tasted great and everyone was talking about it.

The explosion in news, information, and selling the dream/showcasing the nightmare were the perfect recipe to create a new breed of investor: the short-term, growth-oriented trader.

"Old School" Investing Gets Murky

As "growth" and "value" became investment strategies, Wall Street built mutual funds and portfolio allocations around them. In time, "value investing" began to drift from its original meaning of "buying a sustainable business when it is on sale" to today's Wall Street definition of "investing in stocks that have low price to earnings ratios."

The Value Pretender

That fundamental shift in the definition of "value investing" leads us to Seth Klarman's Margin of Safety:

Value investing" is one of the most overused and inconsistently applied terms in the investment business. A broad range of strategies make use of value investing as a pseudonym. Many have little or nothing to do with the philosophy of investing originally espoused by Graham. The misuse of the value label accelerated in the mid-1980s in the wake of increasing publicity given to the long-term successes of true value investors such as Buffett at Berkshire Hathaway, Inc. (BRK.A, BRK.B), Michael Price and the late Max L. Heine at Mutual Series Fund, Inc., among others. Their results attracted a great many "value pretenders," investment chameleons who frequently change strategies in order to attract funds to manage.

These value pretenders are not true value investors, disciplined craftspeople who understand and accept the wisdom of the value approach. Rather they are charlatans who violate the conservative dictates of value investing, using inflated business valuations, overpaying for securities, and failing to achieve a margin of safety for their clients.

In short, Klarman is making the point that today's so-called value investments and value investors are, by and large, not true value investors in the old-fashioned sense of the word. To paraphrase Klarman: Value pretenders tend to buy what is down, without looking at whether or not it is cheap. They look at the PE ratio versus past PE ratios; they buy if the stock is trading near its 52-week low or wait until it pulls back from its 52-week high.

Investing...Today

Last month I wrote this post about business investing, and how it differs from "value investing" in the now traditional sense of the word. I guess I'm trying to start a revolution — a change in terms to help separate true value investors from value pretenders.

Answering the Question

Aren't you concerned that, by constantly talking about how [the gurus] became so successful, you'll create a following that will, in turn, increase competition and reduce your potential investment returns?

One thing that history has shown us is that most people are never really introduced to business investing, just growth and value investing/investments. And that makes a heck of a lot of sense. If you look at the expense ratio of the F Wall Street portfolio, you'll see that we effected just nine (now ten with the purchase of LNY) transactions in fourteen months. Any broker handling that account would starve to death having us as clients. Last year, four of the largest publicly held Wall Street firms generated more than $425 billion in revenue. To maintain that level of revenue on the backs of business investors, they would need more than 4.5 billion clients — roughly 70% of all individuals in the world.

But, if they can get you to double the number of transactions, they would need half as many clients to achieve the same level of revenue. If, on your own or (more likely) through their mutual funds, they could get you to do 100 transactions a year, they would need just 45 million clients — 99% fewer clients for the same revenue.

Thus, where is Wall Street's incentive to promote business investing?

The unintended result of these discussions about investing — growth investing, value investing/pretending, business investing — is that more people become interested, engaged, and intrigued. Sadly, many of these people don't have Aunt Bea and Grandpa Earl's patience and understanding (or the ability to recognize their lack of understanding) of investing, or the desire to learn how they should invest; so, they will jump from ship to ship in search of fast profits.

(Many people are so disgusted or disheartened with Wall Street and investing that they simply put it on the back burner, choosing to do nothing rather than risk making a mistake.)

This continued and growing trend will add more and more volatility which, in turn, can actually increase the potential for profits for true value investors but reduce the overall expected return for most "traditional" investors as they continue to trade and invest on emotion and lack of coherent, intelligent strategy.

Is value investing/pretending dead? It will have its moments in the sun. But mark my words: Business investing (Old-Fashioned Value Investing) will only get better.

(By the way: I don't have an Aunt Bea or Grandpa Earl. With a name like Ponzio? Think about it.)

Monday, August 11, 2008

Sunday, August 10, 2008

For those of you who like to piggy-back: from Gurufocus.com

High Dividend Yield Stocks in Warren Buffett Portfolio: Gannet Co. Inc., Bank of America Corp., SunTrust Banks, GlaxoSmithKline, and U.S. Bancorp

August-10-2008

At this time of uncertainty, above average stock dividends may give investors some comfort. However, the risk of owning high dividend yield stocks is that the dividends may be cut. Buying the high dividend stocks Warren Buffett owns may be a safer way to go. Here are some high yield stocks that have been recently owned by Warren Buffett and other gurus. Gannet Co. Inc. (GCI) Gannet Co. Inc. (“GCI”) operates as a news and information company in the United States and the United Kingdom . It operates in two segments, newspaper publishing and broadcasting and has a newly developed digital strategy segment that was started after several business acquisitions. GCI has a market cap of $4.12 billion; its shares were traded at around $18.02 with a P/E ratio of 4.60 and P/S ratio of 0.58. The dividend yield of Gannett Co. Inc. stocks sits at 9.18 percent. In recent headlines, Gannet Co. Inc. has experienced a 36 percent net loss of income for the second quarter. A subsidiary of Gannet, The Cincinnati Enquirer, has also begun offering optional severance packages to its employees in light of declining economic conditions that have sapped its ad revenues. Total revenue for Gannet Co. Inc. has dropped 10 percent, with publishing advertising suffering the most. Warren Buffet has owned over 3 million shares of GCI since before the second quarter of 2000 at a share price of $59.81 and witnessed its decline after a peak at $89.16 in 2003 to its recent all-time low of $29.05. This recent decline reflects the sentiment held by Warren Buffet that the era of newspapers has passed and that traditional news mediums are being interrupted by the internet. Other gurus also have shares in GCI. As of the first quarter of 2008, John Rogers increased his shares in CGI 62 percent from the previous quarter while David Dreman decreased his shares 51.37 percent over the same period. Charles Brandes, Brian Rogers, NWQ Managers, Arnold Van Berg and Warren Buffet maintained their shares in the company despite the drop in share price. Guru Jean-Marie Eveillard, however, sold out his shares in the first quarter of 2008. Director of GCI, Arthur H Harper, bought shares of stock recently, near the end of the second quarter of 2008 and Senior Vice President and Chief Digital Officer Christopher D Saridakis also bought shares at the end of April 2008. The price per share has fallen an average 24.69 percent since April. Bank of America Corp. (BAC) Bank of America (“BAC”) is one of the world’s leading financial services and banking companies. It serves individual small businesses, commercial, corporate and institutional clients across the U.S. and around the world. Bank of America Corp. has a market cap of $148.42 billion; its shares were traded at around $33.33 with a P/E ratio of 18.35 and P/S ratio of 3.01. The dividend yield of Bank of America Corp. stocks is at 8.65 percent. After picking up Countrywide, and enduring several volatile quarters, Bank of America has become the nation’s largest home lender. However, Bank of America has yet to record a quarterly loss through the current credit crunch. The secret to success? Bank of America has diverse business segments, including a sizeable credit card division and a flourishing wealth management division. Warren Buffet has owned BAC stock since before the second quarter of 2007 and has witnessed the stock decline in value from $48.89 per share to $37.91 per share by the end of the first quarter of 2008. Along with Richard Pzena, David Dreman, Chris Davis, Kenneth Fisher, Dodge & Cox, NWQ Manager, Ruane Cunniff, and Tweedy Browne, Warren Buffet has maintained his shares in the company. His holdings currently stand at 9,100,000 shares. On the other hand, Brian Rogers, Hotchkis & Wiley, and Richard Snow increased positions in the first quarter of 2008 in BAC by 200 percent, 27.82 percent and 19.18 percent respectively from the previous quarter while Irving Kahn reduced his position 30.66 percent from the last quarter in 2007. Several Directors in the company bought shares recently as well, Jackie M Ward, Thomas M Ryan, and William Iii Barnet each bought shares in the last several months. SunTrust Banks (STI) SunTrust Banks (“STI”) is a commercial banking institution that provides a wide range of services to accommodate the financial needs of its clients. Its primary businesses include deposit and credit services as well as trust and investment services. STI has a market cap of $14.85 billion; its shares were traded at around $42.01 with a P/E ratio of 11.87 and P/S ratio of 2.13. The dividend yield of SunTrust Banks Inc. stocks is high at 8.04 percent. As reported by Triangle Business Journal, SunTrust Banks recently acquired First Priority Bank for $214 million and the assets for $42 million. SunTrust is the third largest bank in the Bradenton , Florida area where Priority was based. Warren Buffet has owned shares of STI since before the second quarter of 2000 and seen the price per share fluctuate from $45.69 to a peak of $85.74 back down to the first quarter price of $55.14, reporting an overall price increase of 18.49 percent. Although Warren Buffet began with 6.6 million shares of STI, he now owns 3.2 million shares after making sales after the second quarter of 2001 and again after the second quarter of 2004. All the gurus who own the stock have maintained their number of shares, including David Dreman, Brian Rogers, Chris Davis, Kenneth Fisher, Dodge & Cox and Ruane Cuniff. However, recently, in April, STI’s CFO, Mark A Chancy bought 3,000 shares of stock in his company at $52.56 a share and the price has decreased 20.07 percent since. Directors David H Hughes, G Gilmer Iii Minor, and Alston D Correll all also recently bought 10,000, 4,000 and 75,000 shares of stock, respectively, in July. GlaxoSmithKline (GSK) GlaxoSmithKline (“GSK”) is one of the world's leading research-based pharmaceutical and healthcare companies and is committed to improving the quality of human life by enabling people to lead a fulfilled and active life. They also have leadership in four major therapeutic areas: anti-infectives, central nervous system (“CNS”), respiratory, and gastro-intestinal/metabolic therapy. GSK has a market cap of $119.49 billion; its shares were traded at around $46.34 with a P/E ratio of 12.80 and P/S ratio of 2.64. The dividend yield of GSK stocks is higher than average at 4.62 percent. Boston Business Journal recently reported a $15 million milestone payment from GlaxoSmithKline to Tolerex Inc. in order to support a clinical trial for diabetes treatment. However, GSK also recently declined a lung cancer developmental treatment with collaborative partner Exelixis. Currently, GSK stocks have experienced rising fluctuating prices. Warren Buffet has owned 1.5 million shares of GSK since about the fourth quarter of 2007 and seen a price decline of 15.79 percent from $50.39 to $42.43 in the first quarter of 2008. Two other gurus also initiated positions in GSK, Bill Nyguen and Bruce Berkowitz bought 2 million and 2.3 million shares respectively during the first quarter of 2008. Other gurus maintained their shares in GSK, such as Dodge & Cox, Richard Snow, Sarah Ketterer, Edward Owens, NWQ Managers, Kenneth Fisher, John Keeley, Charles Brandes, and Tweedy Browne. U.S. Bancorp (USB) U.S. Bancorp (“USB”) is a financial services holding company. They operate full-service branch offices and ATMs and provide a comprehensive line of banking, insurance, and investment services to consumers, businesses, and institutions. USB is also the parent company of Firstar Bank and U.S. Bank. U.S. Bancorp has a market cap of $53.05 billion and its shares were traded at around $30.47 with a P/E ratio of 13.28 and P/S ratio of 4.06. The dividend yield of USB stocks is higher than average at 5.52 percent. Recently U.S. Bancorp has had many insider buys which indicates a healthier, rebounding market. It has held up in light of the credit crises however, according to Morningstar, it was changing hands at single-digit multiples of below-trend earnings as investors fled the sector, before the big bounce in financials a few weeks ago. Warren Buffet has owned shares of USB since before the second quarter of 2001 and seen the price per share rise from $22.79 to its current end of first quarter price of $32.26. He has also increased his holdings from 6.2 million to 68.6 million in that time. Dodge & Cox just initiated shares in USB in the first quarter, while George Soros increased his shares 30.29 percent and Ruane Cunniff increased his shares 17.42 percent, both from the last quarter of 2007. On the other hand, Bill Nygren and Ronald Muhlenkamp both decreased their shares by 23.19 percent and 53.93 respectively while David Dreman, Wallace Weitz, Tweedy Browne, Kenneth Fisher, Brian Rogers, and Jean-Marie Eveillard all maintained their shares in the company. Chairman, President, and CEO Richard K Davis just sold 173,673 shares of USB stock in July, and the price has increased 6.13 percent since. Vice Chairman, Andrew Cecere sold 50,000 shares of stock in mid April at the price of $33.10 and the price has declined 7.95 percent since then. Finally, Directors Jerry W Levin , David B Omaley , Arthur D Jr Collins , Joel W Johnson , Craig D Schnuck , and Douglas M Jr Baker all recently bought shares of USB, while Directors Terrance R Dolan , Joseph C Hoesley , P.w. Parker , and Diane L Thormodsgard all recently sold their shares.

Thursday, August 7, 2008

American Eagle Outfitters: fabulous fundamentals but no moat

American Eagle Outfitters: Impressive Company, Tough Market

- Font Size:

- Print

Most Americans are familiar with American Eagle Outfitters (AEO). The company runs over 950 American Eagle mall-based clothing stores, primarily aiming for the teen and young adult market. More recently, the company has also started 3 new concepts: aerie (50 stores), which sells (as management says) "bras and undies", Martin + Osa, which focuses on sportswear for the 25-40 age range, and 77steps, a new concept aiming for the baby and youth market. AE only sells it's own proprietary brands instead of sourcing outside labels. Their niche is "affordable fashion". In shopping terms, this would be a step above Target (TGT) and a step below Abercrombie & Fitch (ANF).

First, the positives. American Eagle is an extremely well run company. MFI return on capital levels have averaged about 69% since 2004, which is superb efficiency. Cash flow generation is similarly impressive, with free cash flow margin showing a 5-year 16% average. The company has compounded earnings per share at a 32% clip over that period. The balance sheet sparkles, with 370 million in cash versus no debt. Finally, management has been quite shareholder friendly, especially when compared to peers. American Eagle boasts a 3% dividend at today's prices, and payout ratio of free cash flow is only about 22%. The current dividend is quite safe and there is plenty of room for more dividend hikes. Any way you slice it, this is an effective company.

Even more exciting, American Eagle stock today boasts statistics that would make any value investor raise an eyebrow. Earnings yield is nearly 22%, or for old fashioned types, a 7.1 enterprise value (EV) to price ratio - insanely cheap. EV to sales is under 1. Free cash yield, my favorite valuation statistic, is huge at 15% (EV/free cash flow is 6.7). These are fire sale prices based on past levels of earnings and cash flow.

There is certainly a large amount of pessimism built into this stock - way too much, in the opinion of MagicDiligence. American Eagle's flagship stores are nearing saturation, but the aerie concept could have the potential to grow into a several hundred store chain. Also, slower expansion improves free cash flow generation, allowing more stock buybacks and dividend increases. A quick look at the Magic Formula screen shows a whole slew of clothing retailers being cheap... a clear sign that it's the industry, and not the company, being discounted. And when something is cheap solely because of short term macro-economic factors, it could be a good time to buy. American Eagle is a pretty good bet to bounce back strongly, and that's why MagicDiligence has a buy opinion.

Still, AE is not Top Buy material. Clothing retail, especially to teenagers, is a classic no moat business. There is a TON of competition in this space. Aeropostale (ARO), Abercrombie & Fitch (ANF), Gap (GPS), and PacSun (PSUN) are just a few of the competitors, to say nothing of the specialty stores as well as larger retailers such as Kohl's (KSS). Most all of these are well run companies with strong financial health and cash flow. The teen and young adult set are notoriously fickle on fashion. Ask Gap or PacSun shareholders about the pain when a teen clothier messes up it's product offering, even for just a few months. Compare this to a wide moat firm like Microsoft (MSFT), who has blown billions of dollars on sinkholes like MSN and the Zune, only to remain ludicrously profitable. All AE has is it's management, and there is little room for error.

In a nutshell, MagicDiligence loves American Eagle the company, but really and truly hates the business it', s in. It's a good buy for the do-it-yourself Magic Formula investor. But there are too many other Magic Formula entries with strong, built-in competitive advantages to recommend AEO as a Top Buy.

Wednesday, August 6, 2008

A "Sin" Stock with growth and value characteristics

Diageo DEO: is a 122 year old UK based liquor, beer and wine producer and distributor to 180 countries across the globe. It is the largest company in the world of its kind and has the majority market share, particularly in Asia. Its products are skewed toward premium brands. 8 of the top 20 brands in the world are owned by DEO including Guiness and Cuervo. Diageo has even put a foothold in "Second Life", the famous online multiplayer game (see picture above).

- secular product supposedly "recession-proof"

- product obsolescence not an issue in an industry with a very slow rate of change

- some inventory (i.e. Scotch which is the fastest growing product segment) actually increases in value over time!

- double digit growth in Asia

- predictable cash flows (almost $3 Billion/year!) and fat net margins exceeding 20%

- distribution scale and efficiency (along with valuable brands) gives DEO a wide economic moat

- being based in the UK, revenues (and the stock price) are measured in the British pound: historically one of the most stable world currencies

- eye popping ROE > 35%

- dividend 3.4%

- Morningstar's fair market value = $112/share v.s. recently trading around $70/share--> a 38% discount

- 75% of executive compensation is performance based, helping to align their interests with shareholders

- Enterprise value/EBIDTA = 12: cheap historically for a stable, highly profitable company that deserves a multiple premium

- subject to adverse legal/social exposure ("sin" product)

- ethical funds and investors will generally avoid alcohol purveyors, narrowing the market exposure ever so slightly

- subject to heavy tax burden that may increase in the future

- European market has a been an exceptionally slow grower for the company. Europe has also seen more intense competition and subsequent margin compression

- foreign exchange risk of British Pound v.s. loonie/USD

- Not cheap by conventional valuations: P/E (trailing) 17 P/B 6 PEG 1.44

The recent run up in the market has spoiled my opportunity to enter a position in DEO. I'd be interested at any share price < $70/share and hold for the very long term. I think that this is an excellent investment with a considerable margin of safety.

l

Friday, August 1, 2008

The Value Gurus View of today's market

Read Bill Miller's shareholder letter here.

With the longest unbroken record of beating the S&P 500 index ever recorded Mr. Miller has gone from a widely admired to highly reviled status: he has badly underperformed over the last 2 years. Investors are so fickle, eh?

Regardless whether you agree with his last 2 years' investment decisions or not, you have to appreciate the tremendous resolve and discipline it takes to invest in the contrarian/value grain-- particularly if you're using other people's money who are not necessarily as patient as you would like. It's pretty easy to be an "armchair asset manager".

I am researching the following opportunities with summaries to follow:

- Legg Mason LM update

- Terex TEX (both TEX and MTW are infrastructure plays with dirt cheap valuations)

- Manitowoc MTW

- Power Corporation of Canada POW.TO

- Indigo Books etc. IDG.TO

- Alimentation Couche-tard update ATD.B.TO

- Diageo DEO

l