Now What? The Great Market Meltdown.

October-7-2008

The US Government passes a $700 billion bailout (or rescue) package, and the markets continue their spiral down. Financial advisors across the country are shouting, "Stay the course!" (Usually from under their desks.)

This crisis is unlike anything we've seen in recent history (and perhaps not-so-recent history); so, what should we do now?

First, Stocks Stink. Consider Buying Bonds.

One year ago (actually, on October 11, 2007) the S&P 500 topped out at 1,576.09. Today, it hit 1,007.97 — a 36% loss. From top to bottom, the Dow lost 32% over the past year. While the news is reporting that we closed at 2004 levels, I think a much more sobering reality needs to be addressed: Over the past ten years — from October 8, 1998 through today's close —[b] the Dow has grown just 2.6% on average for ten straight years.[/b]

Add in dividends, take out some management fees and commissions, and you're lucky to have a 4% or so return for a decade.

(And I won't say anything about how irresponsible, foolish, or downright fraudulent some of Wall Street's finest were over those ten years. Remember Lucent? WorldCom? Enron? Merrill Lynch? Bear Stears? Really — I don't want to beat a dead horse.)

(Morons.)

What can Joe and Jane American learn from all this volatility? First off, remember that stocks stink! A portfolio of solid bonds would have crushed the stock markets over the past ten years; and, while I don't necessarily advocate 100% bonds for everyone, I do think that most people should own them.

Wall Street doesn't talk about bonds except to the extent that they try to get you to buy bonds funds. Individual bonds are not very profitable to Wall Street; bond funds will pay your broker the quarterly kickbacks and allow you to be put on the back burner. (What adviser wants to track all those individual maturities or have to actually do some research?)

That leads me to my first point: Beware of bond funds.

The Danger of Bond Funds

Simply put, when you invest in a bond fund, you give the manager $x to purchase bonds. The manager then takes your cash, pools it with cash from other investors, and buys bonds of varying maturities.

Sounds pretty harmless.

The problem with bond funds is not in the buying, but in the selling. When investors sell their bond funds, the manager must generally sell bonds to pay the investors. The problem is that bond prices change; so, the manager might have to sell some bonds that you personally would have held to maturity.

How does this affect you? Consider this: You want to hold bonds for income and stability; but, in bond funds, your income and stability is directly affected by the actions of other investors. If a ton of people are buying into your bond fund today, your manager will be forced to buy bonds for you in a low interest environment. Then, when those same investors want to get out of that bond fund in five years — and if interest rates are higher — your manager might have to sell those low interest, now low priced bonds at a loss.

At the end of the day, you got a raw deal.

Instead, focus on buying individual bonds with the goal of holding them until maturity. If you buy a high quality bond offering a 5.5% yield until June of 2009, you know exactly what to expect — a 5.5% return for two years, and a definite dollar amount upon maturity, regardless of how happy or scared other investors are.

In short, don't let the panic and fear of other investors determine your return if your goal is stability, income, and a defined return.

Second, Realize That Volatility Is Here To Stay.

I'll admit — 6% or 8% daily swings in the markets are out of line. Still, volatility is here to stay. If you recall from this earlier post, the average number of daily transactions in the markets have grown 562% over the past ten years. Every day, 4.4 billion transactions occur, each moving a stock price in a certain direction.

Over the past two weeks, this number has grown to more than 8 billion transactions. If you are waiting for things to calm down, you'll be waiting a long time. There is simply too much excited money floating around to ever return us to consistently small and "comfortable" movements.

If 36% losses make you sick to your stomach, it's time for a reality check and a new strategy. Diversification (ie. holding a bunch of investments) is not the key — asset allocation is what will help you sleep at night.

When you are putting money to work in stocks, you must have a completely iron constitution. If watching your portfolio drop 50% will make you nervous, you shouldn't be 100% invested in stocks. Nobody likes 50% drops and we'd love to avoid them whenever possible; but, if you're 100% invested and prices drop quickly with no fundamental change in your businesses, you'll suffer some big temporary losses in your portfolio.

Combating Volatility the Intelligent Way

Many advisors will tell you that "diversification" will help mitigate losses and maximize returns. Then, they sell you a mutual fund that holds hundreds or thousands of stocks.

It doesn't make sense.

If the key to growing and preserving wealth (as Buffett has said) is putting your money into great investments and great prices, how can it make sense to buy a basket of great, mediocre, and bad companies at great, mediocre, and bad prices?

[i]As of June 30, AllianceBernstein Holding LP; ClearBridge Advisors, a subsidiary of Legg Mason Inc.; Fidelity Management & Research LLC; Barclays PLC unit Barclays Global Investors NA; Wellington Management Co.; and State Street Global Advisors were the mutual-fund managers with the largest stakes in Lehman's stock, according to FactSet.[/i]

So said the Wall Street Journal on September 16, 2008. While most of the funds did not comment, Vanguard's Rebecca Cohen had this to say:

[i]If you look at the absolute number of shares, we end up as one of the larger holders of Lehman...but on a relative basis, it's a relatively small portion of our funds.[/i]

Oops. We lost hundreds of millions of dollars of your money; but hey, you were diversified. You only lost a little (even though you shouldn't have lost anything in Lehman).

The intelligent way to combat volatility is to realize how much volatility you can handle, and then invest the rest in bonds. If you take a step back and realize that 50% losses are possible, then you have a base for building your portfolio.

Comfortable with a 10% drop, but not a 15% drop? Invest 20% in stocks and 80% in bonds and cash. Okay with a 25% drop but not a 30% drop? Put half of your money in stocks and half in bonds.

Focus on intelligently allocating your portfolio, not on broadly diversifying into more and more mediocre and bad investments. After all, [b]those broadly diversified, armchair investor stock and index funds are down just as much — if not more — than the markets right now.[/b]

Don't Change a Darn Thing in Your Approach

It is times like these that many investors panic and change their investment strategy in stocks. The fact that the markets are down does not change the fact that:

1. stocks are pieces of businesses with intrinsic values;

2. the value is the amount of cash that can be taken out of the business during its remaining life; and,

3. price follows value, even if it takes a few years for that to occur.

Stock market volatility

When we bought Johnson & Johnson last year, we looked sheepish, as though JNJ was a boring buy at $62 or so. A few months later, we looked really smart as JNJ topped $72 a share. Today, it was down as much as 14% from its near-$73 high, and many people are kicking themselves thinking, "Boy, I wish I took my profits $10 ago."

Why did we buy Johnson & Johnson at $62? Because we saw more than $62 — and more than $72 — of value. As the company's value continues to grow, we have to sit back patiently until Mr. Market is ready to realize it.

It may take a few months; it may be years.

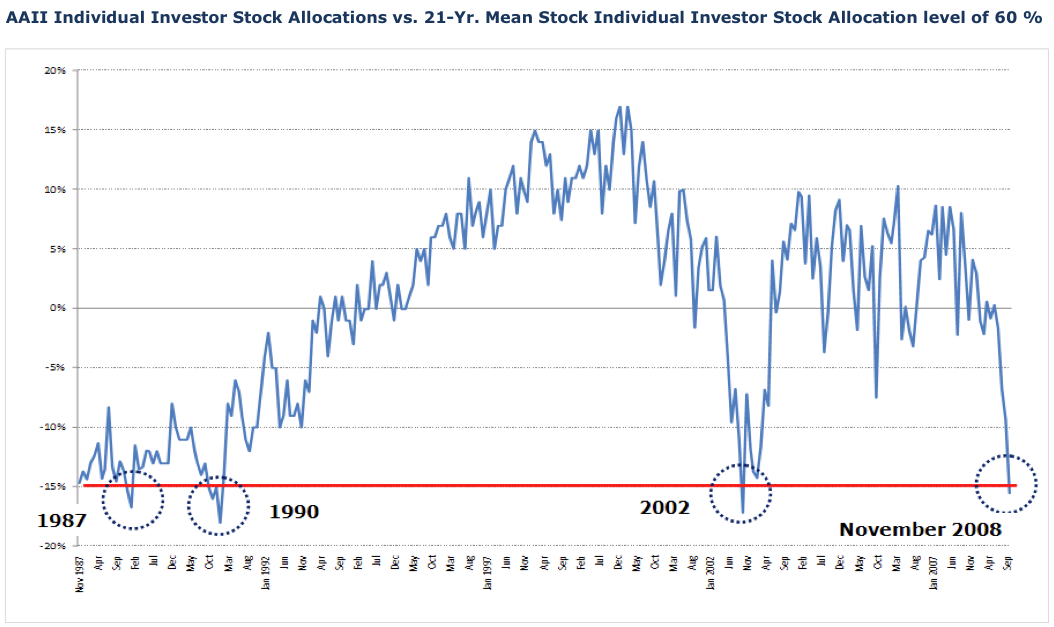

Finally, Realize That It Will Be Better In a Few Years

I wish the internet was around in the 1970s. From its peak on January 11, 1973, the Dow began a two year, 47% slide from 1,067 to its December 9, 1974 low of 570. With no internet or stock market channel, most people continued on saving and investing, cognizant of the losses but not completely panicked or terrified.

Today, the doomsday crowd is calling for the end of the world and a total and final financial collapse. If we were to drop 47% from our high, the Dow would be 2,300 points lower at 7,568. Possible? Absolutely. Anything is possible.

But, like we did after the Great Depression and the 47% drop in 1973 and 1974, and like after so many other times throughout history, we will get through this, great businesses will be more valuable five- and ten-years from now, and price will eventually follow value.

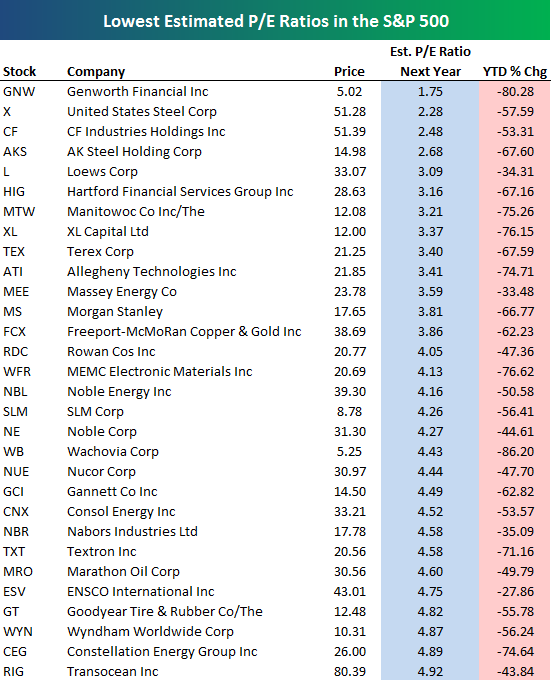

Believe me — there are some very attractive bargains developing in this market, and you should look for them the same way you looked for them when the Dow was at 14,000.

![[Bill Miller]](http://s.wsj.net/public/resources/images/HC-GJ139_Miller_20061201204859.gif)