****Click on the chart above to expand it....*****

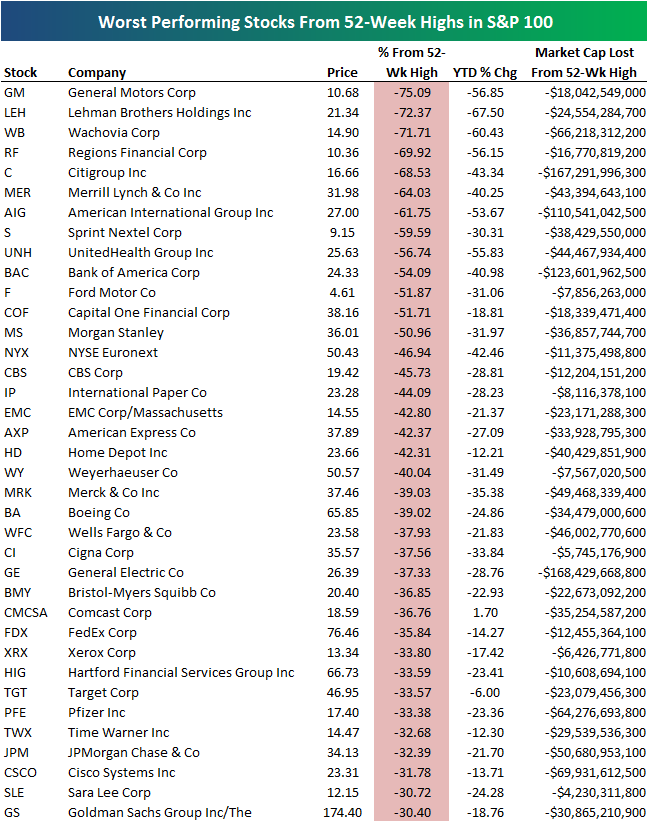

****Click on the chart above to expand it....*****Brutal, eh? Almost anyone could recognize the household names in the chart above. They are all "blue chip" stocks that brokers are supposed to be selling to orphans and widows because they are supposedly safe investments with potential for slow but sure capital appreciation combined by decent dividend yields to provide a little income. They all have large market capitalizations and many are multi-national and have wide economic moats to protect them. What's happened?

Many sane and calm-headed investors are now calling this the worst recession the USA (the world to follow) has seen since the Great Depression, mostly because of 3 negative economic forces striking simultaneously: the great deleveraging from the credit market collapse, the impressive rise in the cost of energy and food, plus the emergence of double digit inflation in most developing nations that had been (up to recently) driving global trade and economic growth. The outcome of these complex and interrelated problems cannot be predicted although it's fun to guess. I suspect that your thoughts about this have as much merit as the most erudite economist-- their track record for prediction of the start and end of bear markets is MUCH worse than a coin flip. It's not that economists are stupid or corrupt, it's just very, very hard to do and my point is: don't even try. Or if you do, just do it for fun and realize that you are participating in an intellectual exercise. Whatever you do, NEVER invest based on a gut feeling about the economic environment and where it is going. Even worse NEVER borrow money and use margin to buy based on that hunch. That's gambling and the house will win 7/10 times. The worst thing that can happen is that you will be correct and think you are a genius--- then the market will crush you.

"The market can remain irrational much longer than you can remain solvent."

John Maynard Keynes

Instead buy equities that have:

Two of my previous picks, Georgia Gulf Corp and Popular may crumble because of increasingly weak balance sheets and poor short term prospects. (as an aside, I have divested my shares in GCC and I have decided to hold on to BPOP because the dividend is continuing to be paid (how much longer?) and I suspect that the company's regional virtual monopoly in PR along with latino customer loyalty may sustain it to emerge virtually competitor-free.

Clarke CKI, is a favourite small cap private equity holding of mine although I have become increasingly concerned lately by the management's spending spree: they've taken Art in Motion private and bought large stakes in several other trusts as well as Liquidation World. These all may well prove to be great long term investments, particularly for such skilled catalyst/activists as the Armoyan crew. HOWEVER, the balance sheet is deteriorating and I don't like that. Over $40 million in cash has been converted to investments with poor short term prospects (particularly the market value of those investments) and as of Q1 2008 Clarke only had 2 million dollars of cash. Since that time CKI has offered to buy back $6.5 million of its outstanding 29 million common shares.... after buying sizable amounts of LW, Amisco and AIM units/shares! The only way they could achieve all of these transactions is to take on yet more debt and I calculate the D:E ratio is sitting close to 1 today. I'm not certain that depleting the cash cushion in current market conditions is prudent and I am considering paring back my position. I am reluctant to do so because I like the business plan very much. At $6.55/share CKI is trading at least 10% discount to NAV/book value; however, I feel that margin of safety for the investment has deteriorated significantly and if economic conditions on both sides of the border go even further downhill, I'm worried that little CKI will not survive.

On the other hand, Clarke Inc's big brother Onex Corp OCX is going exactly the opposite direction. It is aggressively increasing capital. Like Brookfield Asset Management (another favourite), OCX's risk management is quite clever: it uses non-recourse clauses in its financing to protect the parent holding company while positioning itself to take advantage of its markedly financially weakened targets. More on Onex in my next post....

l

Disclosure: My wife will be placing a bid for OCX shares at $29 soon.

- proven management that can execute a simple, easy to understand business plan (and have a track record at least 5 years long)

- preferably in a slowly changing industry with predictable cash flows

- have a strong balance sheet with lots of cash and little or manageable debt

- strong free cash flows (Buffett's "owner's earnings")

- a sustainable dividend that matches or exceeds the inflation rate to protect the real return of your investment

- a wide economic moat so that when the bear market blows over (whenever it does) the business emerges well positioned to take even more market share from its much diminished competitors

Two of my previous picks, Georgia Gulf Corp and Popular may crumble because of increasingly weak balance sheets and poor short term prospects. (as an aside, I have divested my shares in GCC and I have decided to hold on to BPOP because the dividend is continuing to be paid (how much longer?) and I suspect that the company's regional virtual monopoly in PR along with latino customer loyalty may sustain it to emerge virtually competitor-free.

Clarke CKI, is a favourite small cap private equity holding of mine although I have become increasingly concerned lately by the management's spending spree: they've taken Art in Motion private and bought large stakes in several other trusts as well as Liquidation World. These all may well prove to be great long term investments, particularly for such skilled catalyst/activists as the Armoyan crew. HOWEVER, the balance sheet is deteriorating and I don't like that. Over $40 million in cash has been converted to investments with poor short term prospects (particularly the market value of those investments) and as of Q1 2008 Clarke only had 2 million dollars of cash. Since that time CKI has offered to buy back $6.5 million of its outstanding 29 million common shares.... after buying sizable amounts of LW, Amisco and AIM units/shares! The only way they could achieve all of these transactions is to take on yet more debt and I calculate the D:E ratio is sitting close to 1 today. I'm not certain that depleting the cash cushion in current market conditions is prudent and I am considering paring back my position. I am reluctant to do so because I like the business plan very much. At $6.55/share CKI is trading at least 10% discount to NAV/book value; however, I feel that margin of safety for the investment has deteriorated significantly and if economic conditions on both sides of the border go even further downhill, I'm worried that little CKI will not survive.

On the other hand, Clarke Inc's big brother Onex Corp OCX is going exactly the opposite direction. It is aggressively increasing capital. Like Brookfield Asset Management (another favourite), OCX's risk management is quite clever: it uses non-recourse clauses in its financing to protect the parent holding company while positioning itself to take advantage of its markedly financially weakened targets. More on Onex in my next post....

l

Disclosure: My wife will be placing a bid for OCX shares at $29 soon.

No comments:

Post a Comment