I haven't seen this many opportunities since 2001.

Remember to research each stock carefully-- this involves reading the most recent annual report, at least the most recent quarterly report and transcript of the conference call as well as nosing around for as much 3rd party objective analysis you can find about the company (avoiding traders like the plague). It's boring but effective work.

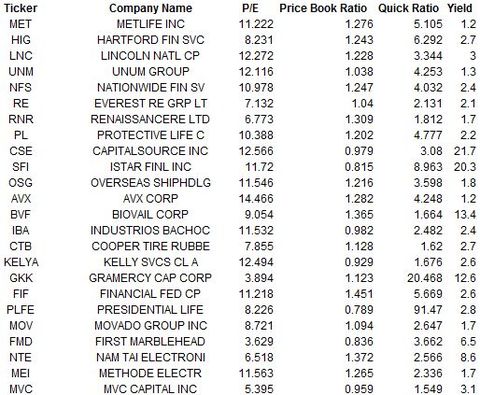

35 Stocks That Ben Graham Would Like Here

- Font Size:

Benjamin Graham is widely regarded to be the founder of modern value investing. His greatest student, Warren Buffett, attributes much of his success to Graham’s teachings.

Though Graham believed that much research is necessary, and that no stock screening methodology is perfect, he did give us some guidelines on how to perform initial screening techniques to limit the number of investments that should be researched further. The following is a list of the attributes he suggests investors look for first. The italics represent our changes to his methodology based on the current market:

1. Price-to-book (P/B) ratio of less than 1.2 (P/B <>

Intangible assets such as intellectual property, brand name recognition, and customer base, are not reflected in the price-to-book ratio, so we suggest a P/B of less than 1.5, rather than 1.2 that Graham discusses. He recognized this fact as well and commented that the P/B could be up to 2.5 if the company has significant intangible assets.

2. Earnings per share [EPS] should have grown by 33% in the past 10 years (Earnings growth of 3% or more in past 5 years).

Earnings thus should have grown around 3% per year. In this exercise, we go back 5 years, looking for 3%+ growth in earnings.

3. The price-to-earnings (ttm) ratio should be below 15.

Perhaps the most common valuation metric, the price-to-earnings ratio allows us to understand the earnings power of the company compared to its price. A high P/E ratio is common among “growth” stocks who are expecting phenomenal growth, but Graham believed that there is no way to be sure growth will continue at a pace that justifies the high price.

4. The current ratio should be above 1.5 (Quick Ratio > 1.5).

The current ratio represents the current assets divided the current liabilities. This ensures that if the company faces a crisis, they have 50% more assets than liabilities to work with. For this exercise, we are going to use the quick ratio instead, which is a more conservative number because it disregards any current assets that might be difficult to unload in a tight situation, such as inventory.

5. The company should pay out a dividend (>1%).

Dividends, in Graham’s opinion, are a very important indicator of a company’s financial health. Not only that, but they indicate a shareholder friendly management team, without which can spell disaster for shareholders. For this screener, we locate stocks that pay out more than 1% annually.

The Results

Now that we have mapped out what Graham thinks makes a good starting point for a list of investments, we will show you the results of running such a screener in today’s market.

The following companies meet or exceed Graham’s initial test and should be considered for review by the intelligent investor.

As always, don’t take these as recommendations, rather as a good place to start researching.

Disclosure: The author of this article does not own shares in any of the companies mentioned.

No comments:

Post a Comment